On the confusing state of the housing market

In this brief, we use the the Zillow Housing Value Index (ZHVI) to assess the changes in the housing market across county, the state, and the region. ZHVI is a widely measure of housing prices and tracks closely with other indices, including Case-Shiller, and Freddie Mac.

The pandemic not only took a health toll but also an economic one. As a result of the significant fiscal stimulus, the majority of households found themselves in better financial health than before 2020. This improvement in financial balance sheets made its way into the majority of sectors but perhaps none more than the housing market. There have been a number of assessments such as this work from the Federal Reserve and many articles by the popular press such as this one examining why housing costs exploded, or this one showing the significant increase in wealth from housig. North Carolina, like the rest of the country, experienced a significant increase in housing prices. The state not only benefited from the national factors but also experienced a significant population boom with the rise of remote work.

Between 2020 and 2022, data from the census shows that the state added more than a quarter of a million people with a significant share moving towards coastal communities.

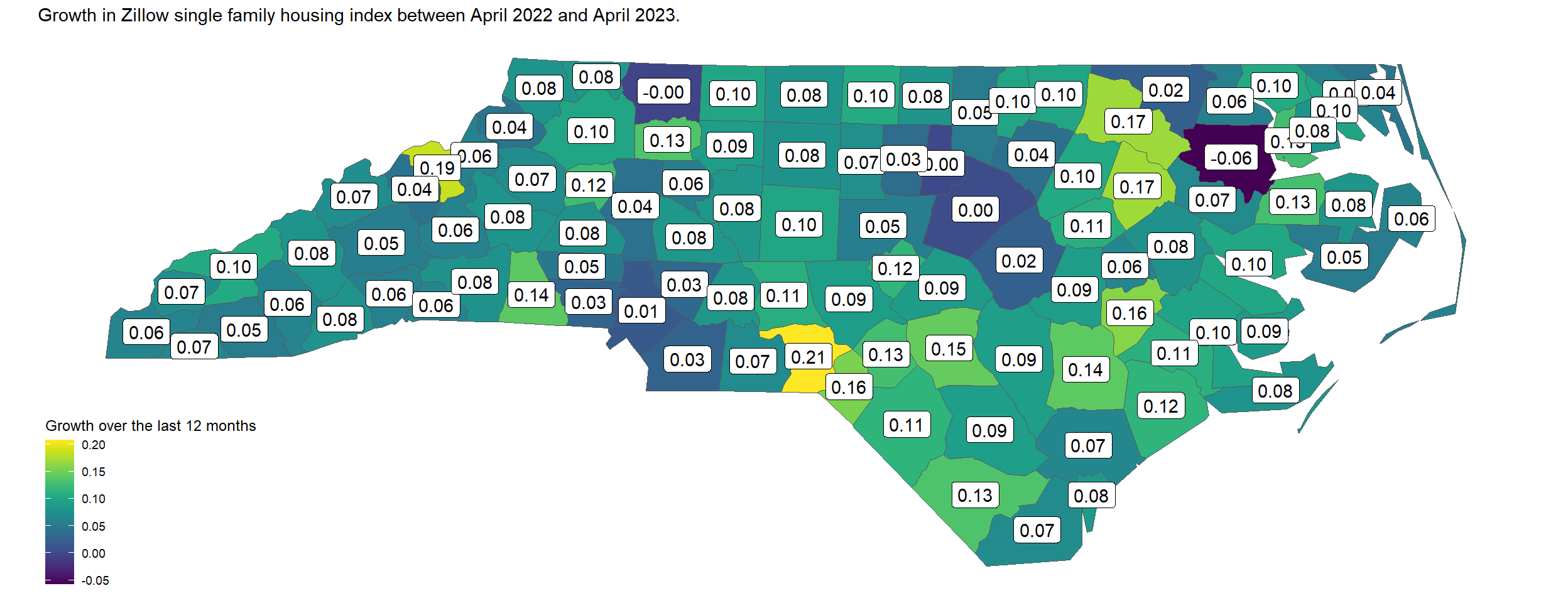

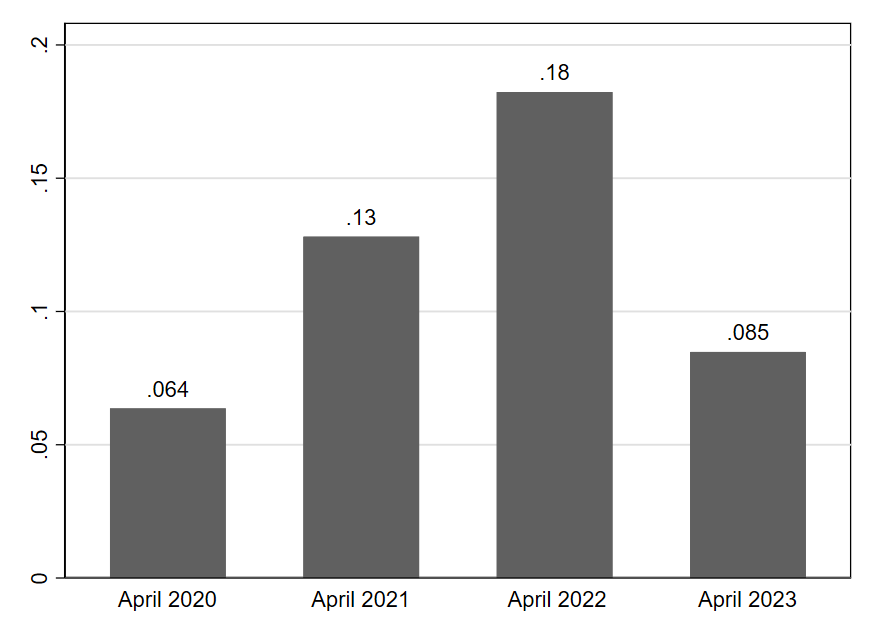

Figure 1: Zillow housing index growth rate for single family homes

Over the past year, the upward pressure on North Carolina housing prices remains strong despite significant increases in home mortgage interest rates. From 2012 through 2019, the average 30-year mortgage rate was 3.97 percent, then declined to a low of 2.65 percent in January 2020 (which contributed to the record demand for housing) to an average of 6.42 percent from January to June 2023. From Figure 1, we can see that even with the proclamations of a housing price correction, prices continued to grow over the last 12 months in most counties across the state. There is, however, considerable variation across the state. In the last twelve months, only two counties - Bertie (-5.7%),and Surry(-0.03%)- experienced negative growth. On the other side of the spectrum, these two communities -Richmond (20.7%) and Mitchell (18.5%)- experienced the fastest growth. Between April 2022 and April 2023, the average growth across counties was 8.1%.

How do prices compare to pre-pandemic times?

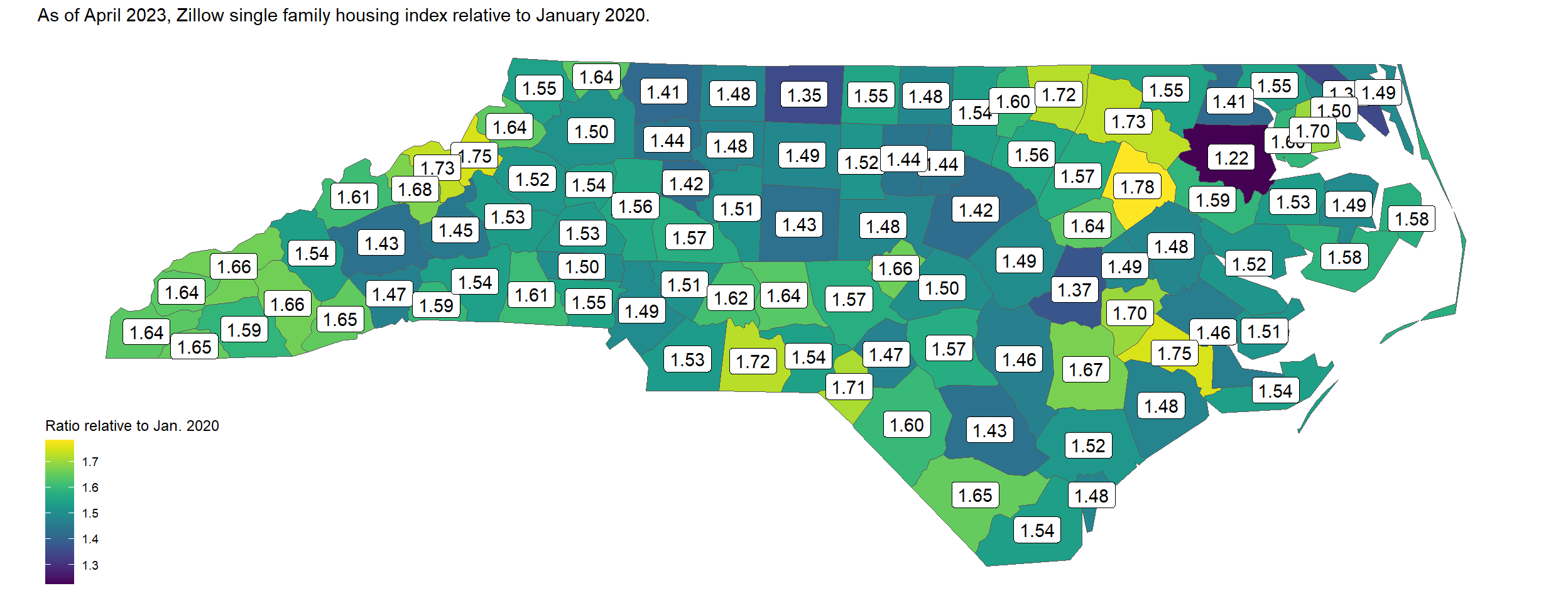

Figure 2: Single family prices relative to pre-pandemic times

On average, relative to January 2020, the Zillow housing index shows that prices across the state for single family homes have increased in every county. New Hanover experienced a 48% increase, Brunswick 54%, and Pender 52%. While these increases are substantial, it is interesting to see from Figure 3, they are smaller than the gains experienced in a number of other counties around the state.

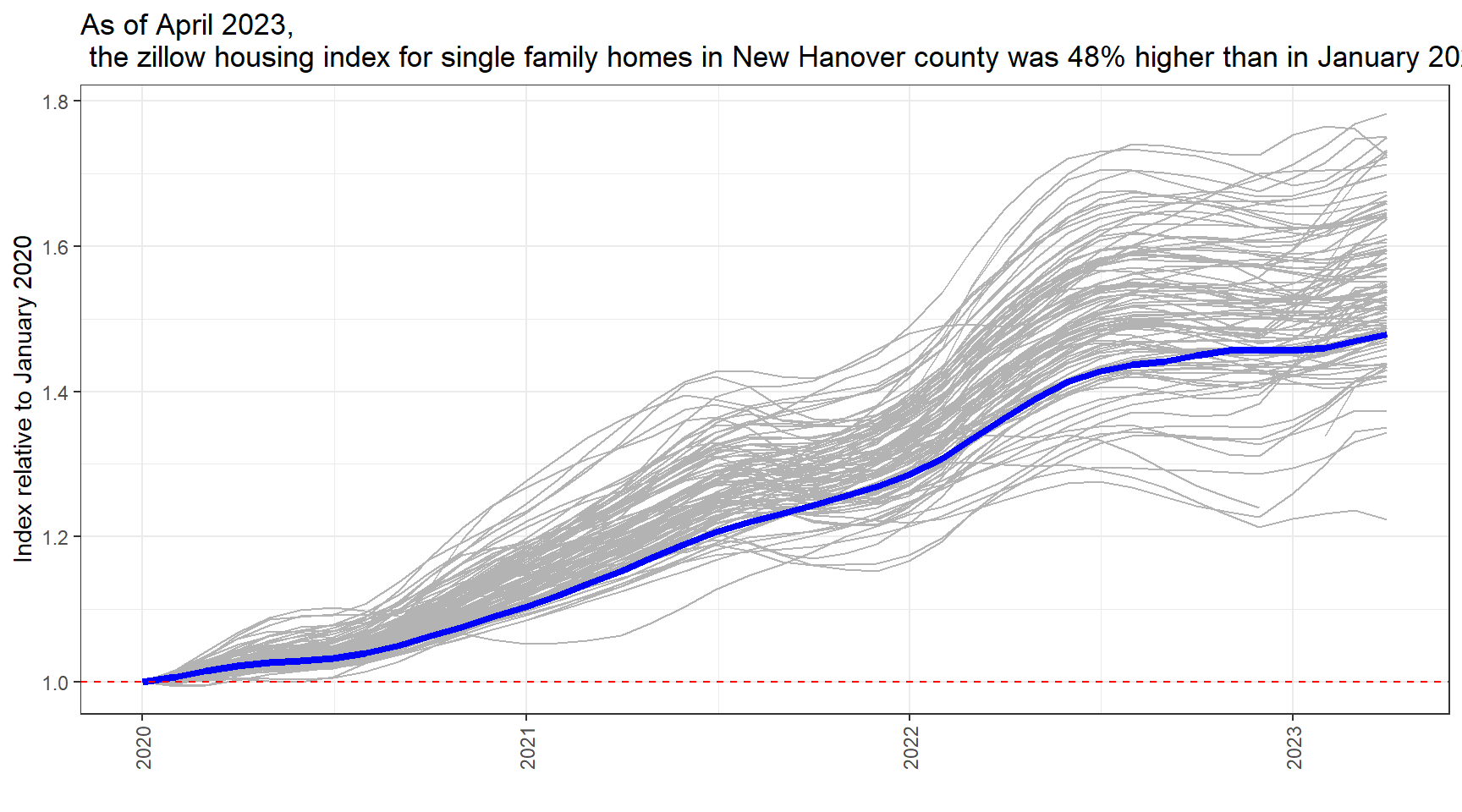

Figure 3: How does New Hanover county’s growth compare?

It is, perhaps, surprising that even with the significant increase at the local level. These increases in New Hanover county -48% since January 2020- pale in comparison to what other counties around the country experienced. New Hanover county’s index relative to January 2020 ranks it only 22nd among the state’s 100 counties.In Figure 4, we show the evolution of the housing index relative to January 2020 for New hanover county, Pender, and Brunswick. It is clear that the rate of price increase has moderated in all three markets. While the rate of increase slowed, we do not observe any of the markets giving up the pandemic gains.

It is, perhaps, surprising that even with the significant increase at the local level. These increases in New Hanover county -48% since January 2020- pale in comparison to what other counties around the country experienced. New Hanover county’s index relative to January 2020 ranks it only 22nd among the state’s 100 counties.In Figure 4, we show the evolution of the housing index relative to January 2020 for New hanover county, Pender, and Brunswick. It is clear that the rate of price increase has moderated in all three markets. While the rate of increase slowed, we do not observe any of the markets giving up the pandemic gains.

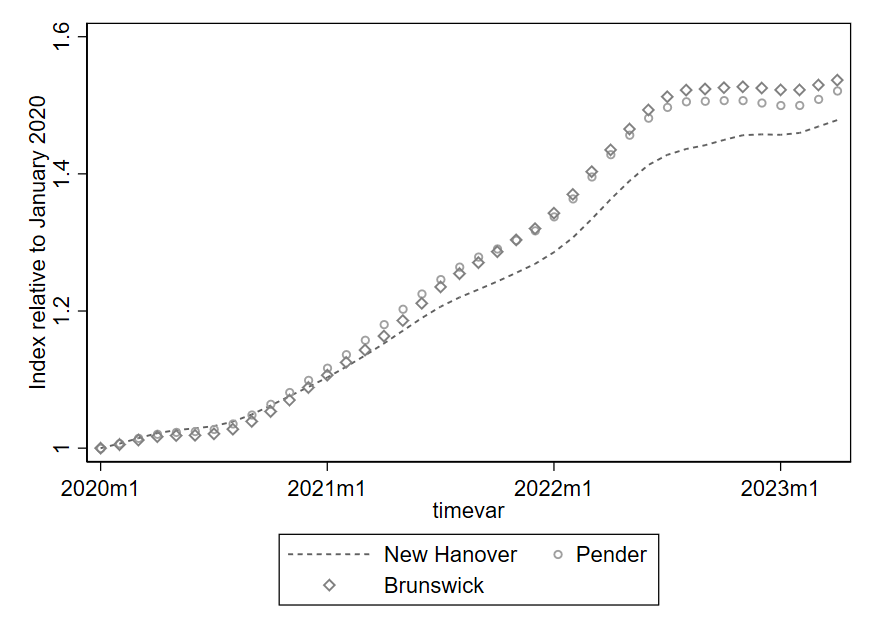

Figure 4: New Hanover, Brunswick, and Pender

Figure 5: New Hanover county’s growth over the last four years

Where do we go from here?

In the past 4 years, the zillow housing index shows that single family homes have increased by almost 50% in New Hanover county. Most of the increase -31%- occurred in 2021 and 2022. Since then, while prices have remained elevated, the rate of growth has slowed. The rise in interest rates has certainly affected both buyers and sellers and has left the housing market in a standstill as buyers are hesitant to purchase at elevated rates and sellers are hesitant to trade the low interest rates they locked into their current property for higher rates in their new homes. It is unlikely we will see increases in prices similar to the 2021 and 2022 periods but it is also unlikely that we will see a significant correction given the significant equity households hold and the relatively limited inventory available. Furthermore, the Federal reserve’s commitment to taming inflation means it is unlikely we will see a reversal in interest rates.